FinOptions XL 3.0.2

FinOptions XL 3.0.2

Excel Financial Analytics Add-in valuing option price, risk sensitivities and implied volatility on a broad range of financial instruments including options, futures, exotic, bond options and interest rate assets directly within your spreadsheet.

Last update

19 Nov. 2013

Licence

Free to try |

$299.00

OS Support

Windows 98, Windows Me, Windows NT, Windows 2000, Windows XP, Windows Server 2003, Windows Vista, Windows 7, Windows 7 x64, Windows Vista x64, Windows Server 2008, Windows XP x64, Windows 8, Windows 8 x64

Downloads

Total: 543 | Last week: 4

Ranking

#199 in

Accounting & Billing Software

Publisher

Derivicom, Inc

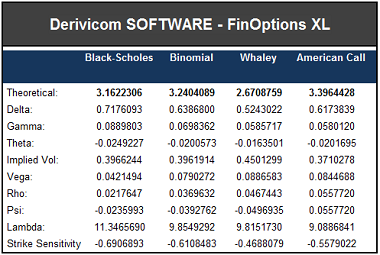

Screenshots of FinOptions XL

FinOptions XL Publisher's Description

FinOptions XL is an Excel Add-in that extends its functionality by adding functions for analyzing derivatives. Similar to the built-in functions in Excel, FinOptions XL functions can be added directly into the cell formulas.

FinOptions XL provides a complete collection of financial functions for analyzing derivatives on various types of securities and assets. FinOptions XL calculates price and the risk sensitivities as well as implied volatility and implied strike using either the Black-Scholes, French Black-Scholes, Cox-Ross-Rubinstein and Hull binomial, Whaley, Bjerksund-Stensland, Merton’s jump-diffusion, or the Roll, Geske, and Whaley American call model.

FinOptions XL functions can adjust for continuous dividend yield and discrete dividends as well as yield rates, which allows the user to price options on: bonds, commodities, equities, foreign currencies, futures and stocks.

FinOptions XL has a sample template and documentation that accompany the software to demonstrate each of the functions and give the user to starting point to being using them.

FinOptions XL was built on our C++ written developer library, which provides lightning fast calculation.

FinOptions XL provides a complete collection of financial functions for analyzing derivatives on various types of securities and assets. FinOptions XL calculates price and the risk sensitivities as well as implied volatility and implied strike using either the Black-Scholes, French Black-Scholes, Cox-Ross-Rubinstein and Hull binomial, Whaley, Bjerksund-Stensland, Merton’s jump-diffusion, or the Roll, Geske, and Whaley American call model.

FinOptions XL functions can adjust for continuous dividend yield and discrete dividends as well as yield rates, which allows the user to price options on: bonds, commodities, equities, foreign currencies, futures and stocks.

FinOptions XL has a sample template and documentation that accompany the software to demonstrate each of the functions and give the user to starting point to being using them.

FinOptions XL was built on our C++ written developer library, which provides lightning fast calculation.

Look for Similar Items by Category

Feedback

- If you need help or have a question, contact us

- Would you like to update this product info?

- Is there any feedback you would like to provide? Click here

Beta and Old versions

Popular Downloads

-

Kundli

4.5

Kundli

4.5

-

Macromedia Flash 8

8.0

Macromedia Flash 8

8.0

-

Cool Edit Pro

2.1.3097.0

Cool Edit Pro

2.1.3097.0

-

Hill Climb Racing

1.0

Hill Climb Racing

1.0

-

Cheat Engine

6.8.1

Cheat Engine

6.8.1

-

Grand Theft Auto: Vice City

1.0

Grand Theft Auto: Vice City

1.0

-

Horizon

2.9.0.0

Horizon

2.9.0.0

-

C-Free

5.0

C-Free

5.0

-

Microsoft Office 2010

Service...

Microsoft Office 2010

Service...

-

Windows XP Service Pack 3

Build...

Windows XP Service Pack 3

Build...

-

Vector on PC

1.0

Vector on PC

1.0

-

Netcut

2.1.4

Netcut

2.1.4

-

Ulead Video Studio Plus

11

Ulead Video Studio Plus

11

-

AtomTime Pro

3.1d

AtomTime Pro

3.1d

-

Grand Auto Adventure

1.0

Grand Auto Adventure

1.0

-

Iggle Pop

1.0

Iggle Pop

1.0

-

WhatsApp Messenger

0.2.8082

WhatsApp Messenger

0.2.8082

-

Age of Empires

1.0

Age of Empires

1.0

-

Minecraft

1.10.2

Minecraft

1.10.2

-

Mozilla Firefox

108.0...

Mozilla Firefox

108.0...